Saturday, October 31, 2015

Types of Taxes in The United States - Excise Taxes

Excise taxes are taxes paid when purchases are made on a specific good, such as gasoline. Excise taxes are often included in the price of the product. There are also excise taxes on activities, such as on wagering or on highway usage by trucks. Excise tax has several general excise tax programs. One of the major components of the excise program is motor fuel. Excise taxes are usually paid initially by the manufacturer or retailer.

Types of Taxes in The United States - Property Tax

Property Tax is a capital tax on property imposed by municipalities; based on the estimated value of the property. Deductible real estate taxes are generally any state, local, or foreign taxes on real property. They must be charged uniformly against all property in the jurisdiction at a like rate. Many states and counties also impose local benefit taxes for improvements for streets, sidewalks, and sewer lines. These taxes cannot be deducted. However, a taxpayer can increase the cost basis of the property by the amount of the assessment. Local benefits taxes are deductible if they are for maintenance or repair, or interest charges related to those benefits.

Deductible personal property taxes are those based only on the value of personal property such as a boat or car. The tax must be charged to the taxpayer on a yearly basis, even if it is collected more than once a year or less than once a year.

Types of Taxes in The United States - Sales Taxes

Sales Taxes is a tax imposed by a state or local government on sales collected by retailers at the point-of-sale. It's based on a percentage of the selling prices of the goods and services. Forty five states, plus the District of Columbia impose a sales tax. If the taxpayer files a Form 1040, and itemizes deductions on Schedule A, he or she has the option of claiming either state and local income taxes or state and local sales taxes. (the taxpayer cannot claim both) if the taxpayer saved his or her receipts throughout the year he or she can add up the total amount of sales taxes actually paid and claim that amount.

Many states exempt charitable, religious, and certain other organizations from sales or use taxes on goods purchased for the organization's use. Generally such exemption does not apply to a trade or business conducted by the organization.

Many states exempt charitable, religious, and certain other organizations from sales or use taxes on goods purchased for the organization's use. Generally such exemption does not apply to a trade or business conducted by the organization.

Types of Taxes in The United States - Gift Tax

The Gift Tax is a tax on the transfer of property by one individual to another while receiving nothing, or less than full value in return. The tax applies whether the donor intends the transfer to be a gift or not. The Gift Tax applies to the transfer by gift of any property. The taxpayer makes a gift if he or she gives property (including money), or the use of or income from property without expecting to receive something of at least equal value in return. If the taxpayer sells something at less than its full value or if he or she makes an interest-free or reduced-interest loan, he or she may be making a gift. The annual exclusion for gifts is $14,000 for the 2014 tax year.

Its considered non-taxable gifts:

- Gifts that are not more than the annual exclusion for the calendar year;

- Gifts to a political organization for its use;

- Gifts to charities;

- Gifts to one's (US Citizen) spouse;

- Tuition or medical expenses one pays directly to a medical or educational institution for someone. Donor must pay the expense directly. If donor writes a check to donee and donee then pays the expense, the gift may be subject to tax.

Friday, October 30, 2015

Types of Taxes in The United States - Estate Tax

Estate Tax is a tax levied on an heir's inherited portion of an estate if the value of the estate exceeds an exclusion limit set by law. The Estate Tax is mostly imposed on assets left to heirs, but it does not apply to the transfer of assets to a surviving spouse. The right of spouses to leave any amount to one another is known as the "Unlimited Marital Deduction".

When someone in your family dies and the property of the deceased transfers to you, the federal government imposes an estate tax on the value of all that property. You only pay estate tax when the tax on the net taxable estate exceeds your remaining balance of the unified credit.

Use Form 706

Calculating Your Taxes

The main problem in completing a tax return is to figure out what income is taxable and the deductions that can be claimed. The rest is largely mechanical: add and subtract correctly, follow the instructions on the tax return and comply with procedural requirements.

The following checklist might be useful:

- Collect the taxpayer's data;

- Review taxpayer's prior returns;

- Select the proper tax return form;

- Determine gross income by totaling all income not specifically excluded;

- Compute the adjusted gross income (AGI) by subtracting the adjustments;

- Subtract itemized deductions from AGI, if their total exceeds the correct standard deduction amount;

- Subtract the correct number of exemptions to determine taxable income;

- Use the tax table (if taxable income is under $100,000) or the tax computation worksheet (if taxable income is $100,000 or more) to determine/calculate tax amount;

- In the following order:

- Add any alternative minimum tax;

- Reduce any tax due by any tax credits (such as child tax credit, credit for child and dependent care expense, adoption credit, etc);

- Add other taxes (such as self-employment tax, household employment taxes);

- Reduce tax by any payments (such as withholdings, estimated tax payments, earned income credit, etc)

- Determine the tax refund amount or the amount owed;

- Sign and file the tax return on time.

Thursday, October 29, 2015

Death of a Taxpayer and The Final Income Tax Return

If a taxpayer died before filing a return for 2014, the taxpayer's spouse or personal representative may have to file and sign a return for that taxpayer. A personal representative can be an executor, administrator, or anyone who is in charge of the deceased taxpayer's property. If the deceased taxpayer did not have to file a return but had tax withheld, a return must be filed to get a refund. The person who files the return must enter "Deceased", the deceased taxpayer's name, and the date of death across the top of the return. If this information is not provided, it may delay the processing of the return.

The final income tax return is due at the same time the decedent's return would have been due had death not occurred. A final return for a decedent who was a calendar year taxpayer is generally due on April 15 following the year of death, regardless of when during that year death occurred. However, when the due date falls on a Saturday, Sunday, or legal holiday, the return is filled timely if filed by the next business day.

If the taxpayer's spouse died in 2014 and he or she did not remarry in 2014, or if his or her spouse dies in 2015 before filing a return for 2014, the taxpayer can file a joint return. A joint return should show the taxpayer's spouse's 2014 income before death and his or her income for all of 2014. Enter "Filing as surviving spouse" in the area where the taxpayer signs the return. If someone else is the personal representative, he or she must also sign.

The surviving spouse or personal representative should promptly notify all payers of income, including financial institutions, of the taxpayer's death. This will ensure the proper reporting of income earned by the taxpayer's estate or heirs. A deceased taxpayer's social security number should not be used for tax years after the year of death, except for estate tax return purposes.

Filing Your Taxes

The annual income tax return for individuals is due by April 15th. However, when the 15th falls on a weekend (Saturday or Sunday) or a holiday, the due date becomes the next regular working day. Therefore, if the 15th happened to be Saturday, the return would be due on Monday, April 17th.

If the taxpayer uses a fiscal year, the return is due the 15th day of the fourth month after the close of the fiscal year. For example, if the fiscal year ends June 30, his or her tax return due date would be October 15. If the taxpayer is a U.S. citizen or resident alien abroad and files on a fiscal year basis (a year ending on the last day of any month except December) the dual date is 3 months and 15 days after the close of the fiscal year.

If a taxpayer is a U.S. citizen or resident alien residing overseas, or is in the military on duty outside the U.S., on the regular due date of the return, he or she is allowed an automatic 2-month extension to file the return and pay any amount due without requesting an extension. For a calendar year return, the automatic 2-month extension is to June 15.

The deadline for filing tax returns, paying taxes, filing claims for refund, and taking other actions with the IRS is automatically extended if either of the following statements is true:

- The taxpayer serves in the Armed Forces in a combat zone or he or she has qualifying service outside of a combat zone;

- The taxpayer serves in the Armed Forces on deployment outside the United States away from his or her permanent duty station while participating in a contingency operation. A contingency operation is a military operation that is designated by the Secretary of Defense or results in calling members of the uniformed services to active duty (or retains them on active duty) during a war or a national emergency declared by the President or Congress.

The deadline for taking actions with the IRS is extended for 180 days after the later of:

- The last day the taxpayer is in a combat zone, have qualifying service outside of the combat zone, or serve in a contingency operation (or the last day the area qualifies as a combat zone or the operation qualifies as a contingency operation)

- The last day of any continuous qualified hospitalization for injury from service in the combat zone or contingency operation or while performing qualifying service outside of the combat zone.

In addition to the 180 days, the deadline is extended by the number of days that were left for the taxpayer to take the action with the IRS when he or she entered a combat zone (or began performing qualifying service outside the combat zone) or began serving in a contingency operation.

If the person entered the combat zone or began serving in the contingency operation before the period of time to take the action began, the deadline is extended by the entire period of time he or she has to take the action.

If the return is mailed, it must be placed in the mail and postmarked on or before the due date. The practice of filing sooner is encouraged by the IRS. Generally, the earliest possible date is January 1, although few, if any, taxpayers are in a position to file this soon. Employees, for example, must wait for Form W-2 to be issued by the employer. The tax law allows the employer until January 31 to prepare and issue the necessary Forms 1099 or W-2 for the previous year. If the taxpayer anticipates a refund, the sooner the tax return is filed, the sooner results can be expected. Because of the increased workload of the IRS as April 15 approaches, an early filing of a return means that a refund will be processed in less time.

If a taxpayer sends his or her return by registered or certified mail, the date of the filing is the postmark date. The registration receipt is evidence that the return was filed on the postmarked date. If a taxpayer sends a return by certified mail and has a receipt postmarked by a postal employee, the date on the receipt is the postmark date. The postmarked certified mail receipt is evidence that the return was delivered and postmarked on the date stamped by the United States Post Office.

Most returns are filed at regional centers geographically dispersed across the United States. The address of the Internal Revenue Service Office serving the states in which the taxpayer lives can be found in the instructions to form 1040.

Wednesday, October 28, 2015

Valuing Inventories on Tax Year

An inventory is necessary to clearly show income when the production, purchase or sale of merchandise is an income-producing factor. If the taxpayer must account for an inventory in his or her business, he or she must use an accrual method of accounting for his or her purchases and sales.

To figure taxable income, the taxpayer must value his or her inventory at the beginning and end of each tax year. To determine the value, the taxpayer needs a method for identifying the items in his or her inventory and a method for valuing these items. The rules for valuing inventory are not the same for all businesses.

The method the taxpayer uses must conform to generally accepted accounting principles for similar businesses and must clearly reflect income. The taxpayer is inventory practices must be consistent from year to year.

The value of your inventory is a major factor in figuring your taxable income. The method you use to value the inventory is very important. Generally there are two methods for valuing inventory. These methods are cost or lower of cost or market.

- COST METHOD. To properly value your inventory using the cost method, you must include all direct and indirect costs associated with it.

- LOWER OF COST OR MARKET METHOD. Under the lower of cost or market method, compare the market value of each item on hand on the inventory date with its cost and use the lower value as its inventory value.

Tuesday, October 27, 2015

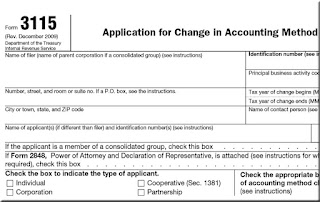

Form 3115 - Application for Change in Accounting Method

The taxpayer can file one Form 3115 if he or she chooses to request to change to the cash method and to change to account for inventoriable items as non-incidental materials and supplies. Two procedures exist under which an applicant may request a change in method of accounting:

- AUTOMATIC CHANGE REQUEST PROCEDURES. Unless otherwise provided in published guidance, you must file under the automatic change request procedure if:

- the change in method of accounting is included in those procedures for the requested year of change, and;

- you are within the scope of those procedures for the requested year of change/

- ADVANCE CONSENT REQUEST PROCEDURES. If you are not within the scope of any automatic change request procedures for the requested year of change, you are requesting is not included in those procedures for the requested year of change, you may be able to file under the advance consent request procedures.

For more information about form 3115 visit: Form 3115

Monday, October 26, 2015

Accrual Method of Accounting

Under the accrual method of accounting, generally the taxpayer reports income in the year it is earned and deducts or capitalizes expenses in the year incurred. The purpose of an accrual method of accounting is to match income and expenses in the correct year.

Generally, the taxpayer includes an amount in gross income for the tax year in which all events that fix his or her right to receive the income has occurred and he or she can determine the amount with reasonable accuracy. Under this rule, the taxpayer reports an amount in his or her gross income on the earliest of the following dates:

Generally, the taxpayer includes an amount in gross income for the tax year in which all events that fix his or her right to receive the income has occurred and he or she can determine the amount with reasonable accuracy. Under this rule, the taxpayer reports an amount in his or her gross income on the earliest of the following dates:

- When he or she receives payment;

- When the income amount is due to him or her;

- When he or she earns the income;

- When title has passed.

Generally, the taxpayer reports an advance payment for services to be performed in a later tax year as income in the year he or she receives the payment. However, if the taxpayer receives an advance payment for services he or she agrees to perform by the end of the next tax year, the taxpayer can elect to postpone including the advance payment in income until the next tax year. However, he or she cannot postpone including any payment beyond that tax year. The taxpayer can postpone reporting income from an advance payment he or she receives for a service agreement on property he or she sells, leases, builds, installs, or constructs. This includes an agreement providing for incidental replacement of parts or materials. However, this applies only if the taxpayer offers the property without a service agreement in the normal course of business. Generally, a taxpayer cannot postpone an advance payment in income for services if either of the following applies:

- He or she is to perform any part of the service after the end of the tax year immediately following the year he or she receives the advance payment;

- He or she is to perform any part of the service at any unspecified future date that may be after the end of the tax year immediately following the year he or she receives the advance payment.

Special rules apply to including income from advance payments on agreements for future sales or other dispositions of goods held primarily for sale to customers in the ordinary course of a taxpayer's trade or business. However, the rules do not apply to a payment (or part of a payment) for services that are not an integral part of the main activities covered under the agreement. An agreement includes a gift certificate that can be redeemed for goods. Amounts due and payable are considered received.

Generally, include an advance payment in income in the year in which the taxpayer receives it. However, the taxpayer can use the alternative method. Under the alternative method, generally include an advance payment in income in the earlier tax year in which the taxpayer:

- Includes advance payments in gross receipts under the method of accounting he or she uses for tax purposes;

- Includes any part of advance payments in income for financial reports under the method of accounting used for those reports. Financial reports include reports to shareholders, partners, beneficiaries, and other proprietors for credit purposes and consolidated financial statements.

Wednesday, October 21, 2015

Cash Method of Accounting

Most individuals and many small businesses use the cash method of accounting. Generally, if the taxpayer produces, purchases, or sells merchandise, he or she must keep an inventory and use an accrual method for sales and purchases of merchandise. Under the cash method, the taxpayer in his or her gross income all items of income he or she actually or constructively receives during the tax year. If the taxpayer receives property and services, he or she must include their fair market value (FMV) in income.

Under the cash method, generally, a taxpayer deducts expenses in the tax year in which he or she actually pays them. This includes business expenses for which he or she contests liability. However, the taxpayer may not be able to deduct an expense paid in advance. Instead, he or she may be required to capitalize certain costs.

An expense a taxpayer pays in advance is deductible only in the year to which it applies, unless the expense qualifies for the 12-month rule. Under the 12-month rule, a taxpayer is not required to capitalize amounts paid to create certain rights or benefits for the taxpayer that do not extend beyond the earlier of the following:

Under the cash method, generally, a taxpayer deducts expenses in the tax year in which he or she actually pays them. This includes business expenses for which he or she contests liability. However, the taxpayer may not be able to deduct an expense paid in advance. Instead, he or she may be required to capitalize certain costs.

An expense a taxpayer pays in advance is deductible only in the year to which it applies, unless the expense qualifies for the 12-month rule. Under the 12-month rule, a taxpayer is not required to capitalize amounts paid to create certain rights or benefits for the taxpayer that do not extend beyond the earlier of the following:

- 12 months after the right or benefit begins;

- the end of the tax year after the tax year in which payment is made.

If the taxpayer has not been applying the general rule (an expense paid in advance is deductible only in the year to which it applies) and/or the 12 month rule to the expenses he or she paid in advance, the taxpayer must obtain approval from the IRS before using the general rule and/or the 12-month rule.

The following entities cannot use the cash method, including any combination of methods that includes the cash method:

- A corporation (other than an S corporation) with average annual gross receipts exceeding $5 million;

- A partnership with a corporation (other than an S corporation) as a partner, and with the partnership having average annual gross receipts exceeding $5 million;

- A tax shelter.

Generally, a taxpayer engaged in the trade or business of farming is allowed to use the cash method for its farming business. However, certain corporations (other than S corporations) and partnerships that have a partner that is a corporation must use an accrual method for their farming business. For this purpose, farming does not include the operation of a nursery or sod farm or the raising or harvesting of trees. (other than fruit or nut trees)

There is an exception to the requirement to use an accrual method for corporations with gross receipts of $1 million or less for each prior tax year after 1975. For family corporations engaged in farming, the exception applies if gross receipts were $25 million or less for each prior tax year after 1985.

Tuesday, October 20, 2015

Tax Year and Accounting Method Choices

An accounting method is a set of rules used to determine when income and expenses are reported on the taxpayer's tax return. His or her accounting method includes not only the overall method of accounting, but also the accounting treatment he or she uses for any material item.

The taxpayer can choose an accounting method when he or she files his or her first tax return. If the taxpayer later wants to change his or her accounting method, he or she must get IRS approval.

No single accounting method is required of all taxpayers. The taxpayer must use a system that clearly reflects his or her income and expenses and he or she must maintain records that will enable him or her to file a correct return. In addition to the taxpayer's permanent accounting books, he or she must keep any other records necessary to support the entries on his or her books and tax returns.

The taxpayer must use the same accounting method from year to year. An accounting method clearly reflects income only if all items of gross income and expenses are treated the same from year to year.

If the taxpayer does not regularly use an accounting method that clearly reflects his or her income, the taxpayer's income will be refigured under the method that, in the opinion of the IRS does clearly reflect income. In general, a taxpayer can compute his or her taxable income under any of the following accounting methods:

- Cash method;

- Accrual method;

- Special methods of accounting for certain items of income and expenses;

- A hybrid method which combines elements of two or more of the above accounting methods.

Sunday, October 18, 2015

The Tax Year

The taxpayer must use a tax year to figure his or her taxable income. A tax year is an annual accounting period for keeping records and reporting income and expenses. An annual accounting period does not include a short tax year.

The taxpayer can use one of the following tax years:

The taxpayer can use one of the following tax years:

- A CALENDAR YEAR. A calendar year is 12 consecutive months beginning on January 1st and ending on December 31st. If the taxpayer adopts the calendar year, he or she must maintain his or her books and records and report his or her income and expenses from January 1st through December 31st of each year. If the taxpayer files his or her first tax return using the calendar tax year and he or she later begins business as a sole proprietor, becomes a partner in a partnership, or becomes a shareholder in an S corporation, he or she must continue to use the calendar year unless he or she obtains approval from IRS to change it, or is otherwise allowed to change it without IRS approval. Generally, anyone can adopt the calendar year. However, the taxpayer must adopt the calendar year if:

- He or she keeps no books or records;

- He or she has no annual accounting period;

- His or her present tax year does not qualify as a fiscal year;

- He or she is required to use a calendar year by a provision in the Internal Revenue Code or the Income Tax Regulations.

- A FISCAL YEAR. A fiscal year is 12 consecutive months ending on the last day of any month except December 31st. If the taxpayer is allowed to adopt a fiscal year, he or she must consistently maintain his or her books and records and report his or her income and expenses using the time period adopted.

- 52-53-WEEK TAX YEAR. The taxpayer can elect to use a 52-53-week tax year if he or she keeps his or her books and records and report his or her income and expenses on that basis. If the taxpayer makes this election, the 52-53-week tax year must always end on the same day of the week. The 52-53-week tax year must always end on:

- Whatever date this same day of the week last occurs in a calendar month;

- Whatever date this same day of the week falls that is nearest to the last day of the calendar month.

- SHORT TAX YEAR. A short tax year is a tax year of less than 12 months. A short period tax return may be required when the taxpayer:

- Is not in existence for an entire tax year;

- Change his or her accounting period.

Identity Protection Personal Identification Number (IP PIN)

The IP PIN helps to prevent the misuse of a taxpayer's Social Security Number or Taxpayer Identification Number on income tax returns. New IP PINs are issued every year. An IP PIN should be used only for the tax year it was issued. IP PINs for 2014 tax returns generally are sent in December 2014. A new CP01A notice will be issued each subsequent year in January for the new filing season as long as the taxpayer's tax account remains at risk for identity theft. If the taxpayer is filing a joint return and both taxpayers receive an IP PIN, only the taxpayer whose Social Security Number (SSN) appears first on the tax return should enter his or her IP PIN.

For 2014, if a taxpayer received an IRS notice providing him or her with an Identity Protection Personal Identification Number (IP PIN), enter it in the IP PIN spaces provided below daytime phone number on the tax return form. The taxpayer must enter the IP PIN exactly as it is shown on the notice CP01A. If the taxpayer did not receive a notice containing an IP PIN, leave these spaces blank. An IP PIN is a number the IRS gives to taxpayers who have:

For 2014, if a taxpayer received an IRS notice providing him or her with an Identity Protection Personal Identification Number (IP PIN), enter it in the IP PIN spaces provided below daytime phone number on the tax return form. The taxpayer must enter the IP PIN exactly as it is shown on the notice CP01A. If the taxpayer did not receive a notice containing an IP PIN, leave these spaces blank. An IP PIN is a number the IRS gives to taxpayers who have:

- Reported to the IRS they have been victims of identity theft;

- Given the IRS information that verifies their identity;

- Had an identity theft indicator applied to his or her account.

Taxpayer Identification Numbers

A Taxpayer Identification Number (TIN) is an identification number used by the Internal Revenue Service (IRS) in the administration of tax laws. It is issued either by the Social Security Administration (SSA) or by the IRS. Most taxpayers will use a Social Security Number (SSN) issued by the SSA. Additional TINs issued by the IRS include:

- Employer Identification Number (EIN);

- Individual Taxpayer Identification Number (ITIN);

- Taxpayer Identification Number for pending U.S. Adoptions (ATIN);

- Preparer Taxpayer Identification Number (PTIN);

A taxpayer generally must list on his or her individual income tax return the social security number (SSN) of any person for whom he or she claims an exemption. If his or her dependent or spouse does not have and is not eligible to get an SSN, the taxpayer must list the ITIN instead of an SSN. The taxpayer does not need an SSN or ITIN for a child who was born and died in the same tax year. Instead of an SSN or ITIN, attach a copy of the child's birth certificate and write DIED on the appropriate exemption line of the tax return.

A Tax Return Prepare Must...

- TAX RETURN PREPARES MUST USE IRS E-FILE. The law requiring paid tax return preparers to electronically file Federal income tax returns, prepared and filed for individuals, trusts and estates started January 1, 2011.

- TAX PREPARES MUST HAVE A PREPARER TAX IDENTIFICATION NUMBER. IRS regulations require all paid tax return preparers and enrolled agents (including attorneys, and CPAs if they prepare for compensation all or substantially all of a Federal tax return or claim for refund) to obtain a Preparer Tax Identification Number (PTIN) before preparing any Federal tax return. A PTIN meets the requirements under section 6109 (a)(4) of furnishing a paid tax return preparer's identifying number on returns that you prepare. In February of 2013 the United States District Court for the District of Columbia modified its order from January of 2013 to clarify that the order does not affect the requirement for all paid tax return preparers to obtain a preparer tax identification number (PTIN). You must renew your PTIN every year during the renewal season which generally starts in October and must be completed by December 31. Your PTIN is your Federal license to prepare taxes and it must be included on all returns you prepare.

Advantages of E-filing your Tax Return

The IRS reminds filers that e-filing their tax return greatly lowers the chance of errors. In fact, taxpayers are about twenty times more likely to make a mistake on their return if they file a paper return instead of e-filing their return. Here are some common errors to avoid:

- WRONG OR MISSING SOCIAL SECURITY NUMBERS. Be sure to enter SSNs for the taxpayer and others on the tax return exactly as they are on the social security cards.

- NAMES WRONG OR MISSPELLED. Be sure to enter names of all individuals on the tax return exactly as they are on their social security cards.

- FILING STATUS ERRORS. Choose the right filing status. There are five filing statuses: 1 - Single, 2- Married Filing Jointly, 3- Married Filing Separately, 4- Head of Household, 5- Qualifying Widow(er) with Dependent Child.

- MATH MISTAKES. When filing a paper tax return, double check the math.When e-filing, the software does the math.

- ERRORS IN FIGURING CREDITS, DEDUCTIONS. Take time and read the instructions in the tax booklet carefully. Many filers make mistakes figuring their earned income tax credit, child and dependent care credit and the standard deduction.

- WRONG BANK ACCOUNT NUMBERS. Direct deposit is the fast, easy and safe way to receive a tax refund. Make sure to enter the bank routing and account numbers correctly.

- FORMS NOT SIGNED, DATED. An unsigned tax return is like an unsigned check. It's invalid. Remember both spouses must sign a joint return.

- ELECTRONIC SIGNATURE ERRORS. if the taxpayer e-files the tax return, he or she will sign the return electronically using a personal identification number.

The Visa Waiver Program (VWP)

The Visa Waiver Program (VWP) enables citizens of participating countries to travel to the United States for tourism or business for 90 days or less without obtaining a United States Visa. You must be a citizen or national of VWP participant country. The following 38 countries are visa waiver program participants:

- Andorra

- Australia

- Austria

- Belgium

- Brunei

- Chile

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Japan

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg

- Malta

- Monaco

- Netherlands

- New Zealand

- Norway

- Portugal

- San Marino

- Singapore

- Slovakia

- Slovenia

- South Korea

- Spain

- Sweden

- Switzerland

- Taiwan

- United Kingdom

Friday, October 16, 2015

Types of Nonimmigrant Visa

USA Non-Immigrant Visas

| Visa Type | Description |

| A-1 | Ambassor, Public Minister, Caree Diplomat or Consular Officer, or immediate family. |

| A-2 | Other foreign government official or employee, or immediate family. |

| A-3 | Attendant, servant, or personal employee of A-1 or A-2, or immediate family. |

| B-1 | Temporary visitor for business. |

| B-2 | Temporary visitor for pleasure. |

| B-1/B-2 | Temporary visitor for business & pleasure. |

| C-1 | Non-Immigrant in transit. |

| C-2 | Non-Immigrant in transit to United Nations Headquarters District under sec. 11.(3), (4), or (5) of the Headquarters agreement. |

| C-3 | Foreign government official, immediate family, attendant, servant or personal employee, in transit. |

| C-1/D | Combined transit and crew member visa. For people serving on a ship or plane, landing or docking temporarily. |

| D | Crew member (sea or air). |

| E-1 | Treaty trader, spouse or child |

| E-2 | Treaty investor, spouse or child |

| E-3 | Australian treaty non-immigrant coming to the United States solely to perform services in a specialty occupation. |

| E-3D | Spouse or child of E-3 |

| E-3R | Returning E3. |

| F-1 | Students, academic, including at colleges, universities, seminaries, conservatories, academic high schools, other academic institutions, or in language training. |

| F-2 | Spouse or child of F-1. |

| F-3 | Canadian or Mexican national commuter student in an academic or language training program. |

| G-1 | Principal resident representative of recognized foreign government to international organization, staff, or immediate family. |

| G-2 | Other representative of recognized foreign member government to international organization or immediate family. |

| G-3 | Representative of non recognized or non member foreign government |

| G-4 | International organization officer or employee, or immediate family |

| G-5 | Attendant, servant, or personal employee of G-1 through G-4, or immediate family. |

| H-1B | Temporary professionals (for specialty occupations such as doctors, engineers, physical therapists, computer professionals. Must have at least a bachelor's degree) |

| H-1B1 | Chilean or Singaporean national to work in a specialty occupation |

| H-1C | Nurse in health professional shortage area |

| H-2A | Temporary worker performing agricultural services unavailable in the United States |

| H-2B | Temporary worker performing other services unavailable in the United States |

| H-3 | Trainees |

| H-4 | Spouse or child of nonimmigrant classified H-1B/B1/1C, H-2A/B, or H-3 |

| I | Representative of foreign information media, spouse or child |

| J-1 | Exchange visitor |

| J-2 | Spouse or child of J-1 |

| K-1 | Fiance of United States citizen |

| K-2 | Child of fiance of United States citizen |

| K-3 | Spouse of United States citizen awaiting availability of immigrant visa |

| K-4 | Child of K-3 |

| L-1 | Intracompany transferee (executive managerial, and specialized knowledge personnel continuing employment with international firm or corporation) |

| L-2 | Spouse or child of intracompany transferee |

| M-1 | Vocational student or other nonacademic student |

| M-2 | Spouse or child of M-1 |

| M-3 | Canadian or Mexican national commuter student (vocational student or other nonacademic student) |

| ...... | |

| NATO-1 | Principal permanent representative of member state to NATO (including any of its subsidiary bodies) Resident in the United States and resident members of official staff; secretary general, assistant secretaries general, or executive secretary of NATO;Other permanent NATO officials of similar rank, or immediate family. |

| ...... | |

| NATO-2 | Other representative of member state to NATO (including any of its subsidiary bodies) including representatives advisers, and technical experts of delegations or immediate family; Dependents of member of a force entering in accordance with the provisions of the NATO status-of-forces agreement or in accordance with the provisions of the protocol on the status of international military headquarters; Members of such a force if issued visas. |

| ...... | |

| NATO-3 | Official clerical staff accompanying representative of member state to NATO (including any of its subsidiary bodies) or immediate family |

| ...... | |

| NATO-4 | Official of NATO (Other than those classifiable as NATO-1), 1098 or immediate family |

| ...... | |

| NATO-5 | Experts, other than NATO officials classifiable under NATO-4, employed in missions on behalf of NATO and their dependents |

| ...... | |

| NATO-6 | Member of a civilian component accompanying a force entering in accordance with the provisions of the NATO status-of-forces agreement; Member of a civilian component attached to or employed by a nonimmigrant headquarters under the "protocol on the status of international military headquarters" set up pursuant to the North Atlantic Treaty; and their dependents. |

| ...... | |

| NATO-7 | Attendant, servant, or personal employee of NATO-1, NATO-2, NATO-3, NATO-4, NATO-5 or NATO-6 classes, or immediate family |

| ...... | |

| O-1 | Nonimmigrant with extraordinary ability in sciences, arts, education, business or athletics |

| O-2 | Nonimmigrant accompanying and assisting in the artistic or athletic performance by O-1 |

| O-3 | Spouse or child of O-1 or O-2 |

| P-1 | International recognized athlete or member of internationally recognized entertainment group |

| P-2 | Artist or entertainer in a reciprocal exchange program |

| P-3 | Artist or entertainer in a culturally unique program |

| P-4 | Spouse or child of P-1, P-2 or P-3 |

| Q-1 | Participant in an international cultural exchange program |

| Q-2 | Irish peace process program partipant |

| Q-3 | Spouse or child of Q-2 |

| R-1 | Nonimmigrant in a religious occupation |

| R-2 | Spouse or child of R-1 |

| S-5 | Certain nonimmigrants supplying critical information relating to a criminal organization or enterprise |

| S-6 | Certain nonimmigrants supplying critical information relating to terrorism |

| S-7 | Qualified family member of S-5 or S-6 |

| T-1 | Victim of a severe form of trafficking in persons |

| T-2 | Spouse of T-1 |

| T-3 | Child of T-1 |

| T-4 | Parent of T-1 under 21 years of age |

| T-5 | Unmarried sibling under age 18 of T-1 under 21 years of age. |

| T-N | NAFTA professional |

| T-D | Spouse or child of NAFTA professional |

| U-1 | Victim of criminal activity |

| U-2 | Spouse of U-1 |

| U-3 | Child of U-1 |

| U-4 | Parent of U-1 under 21 years of age |

| U-5 | Unmarried sibling under age 18 of U-1 under 21 years of age |

| V-1 | Spouse of a lawful permanent resident alien awaiting availability of immigrant visa |

| V-2 | Child of a lawful permanent resident alien awaiting availability of immigrant visa |

| V-3 | Child of V-1 or V-2 |

Friday, October 9, 2015

Considering nationality when you are preparing taxes (Nonimmigrant)

Nonimmigrant is someone who seeks temporary entry to the United States for a specific purpose. A nonimmigrant visa allows a nonimmigrant to enter the United States in one of several different categories, which correspond to the purpose for which the nonimmigrant is being admitted to the United States. For example, a foreign student will usually enter the United States on an F-1 visa, a visitor for business on a B-1 visa, an exchange visitor (including students, teachers, researches, trainees, physicians, au pairs, and others) on a

J-1 visa, a diplomat on a A or G visa, etc. The categories of nonimmigrant visas correspond exactly to the "nonimmigrant status" assigned to each nonimmigrant upon his arrival, based on the purpose for which the nonimmigrant was admitted to the United States. For example, a foreign student who enters the United States on an F-1 visa is considered to be in F-1 student status after he enters the United States; and he will remain in that status until he violates the conditions prescribed for that status, or until he changes to another nonimmigrant or immigrant status with USCIS permission, or until he leaves the United States.

When someone is considered Illegal Alien

An Illegal Alien, also known as an "Undocumented Alien" is an alien who has entered the united States illegally and is deportable if apprehended, or an alien who entered the United States legally but who has fallen "out of status" and is deportable.

An Alien is an individual who is not a U.S. citizen or U.S. National, however an alien is an immigrant who has been granted the right by the United States Citizenship and Immigration Services (USCIS) to reside PERMANENTLY in the United States and work WITHOUT RESTRICTIONS in the United States, there is no "Illegal" alien or "Undocumented" alien. It's just an expression used to talk about someone who is inside the United States without permission.